Since 2016, the maximum loan amount for a conventional mortgage has climbed by about $132,000.

The Federal Housing Finance Agency said on Tuesday that Fannie Mae and Freddie Mac will be able to issue conforming loans with a maximum loan amount of over $726,200.

The conforming loan limit will increase to $726,200 in most of the United States in 2023 from $510,400 in 2020. After a decade without an increase, from 2006 to 2016, the FHFA raised the conforming loan ceiling for the seventh consecutive year in 2023.

The FHFA raised the Fannie Mae and Freddie Mac conforming loan ceiling in 2016 for the first time in ten years, and the increase was $93,400.

Conforming loan ceilings were raised by the FHFA in 2016 from $417,000 to $424,100. The FHFA increased the maximum loan amount from $424,100 in 2017 to $453,100 in 2018. As of 2019, the maximum loan amount has been raised by the FHFA from $453,100 to $484,350. The maximum loan amount increases from $484,350 to $510,400 in 2020. The maximum loan amount has increased to $726,200.

The Housing and Economic Recovery Act of 2008 (HERA) established the baseline loan limit at $726,200 and required that the baseline loan limit not increase again after a period of price declines unless home prices return to pre-decline levels. HERA is responsible for determining the conforming loan limits for Fannie Mae and Freddie Mac.

According to FHFA data, the average price of a home grew by 5.38% during the third quarters of 2018 and 2019. As a result, in 2020, the maximum allowable amount for a conventional mortgage will rise by the same amount. Home prices have gone up because of the increase in their market value.

The maximum loan amount is increased from the baseline conforming loan limit in places where 115% of the local median house value is greater than that figure. The HERA “ceiling” on maximum loan amounts in some locations is 150% of the original loan limit, which is calculated as a multiple of the area median house value.

In 2019, median property values rose across numerous expensive areas, pushing up maximum loan restrictions in many of those places.

In most high-cost areas, the maximum loan amount for a single-family home is increasing from $625,000 to $822,375 (150% of $625,000).

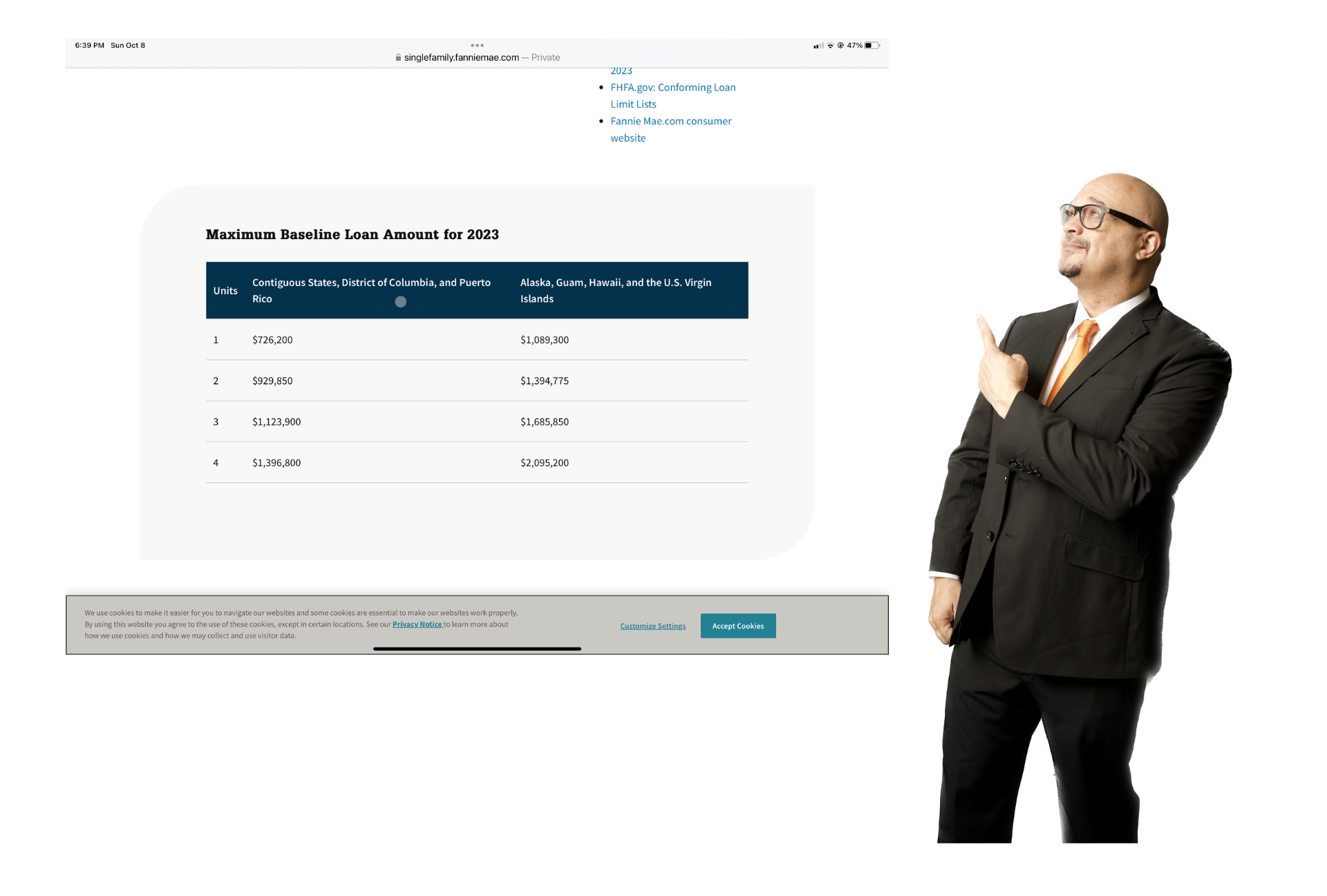

Alaska, Hawaii, Guam, and the U.S. Virgin Islands all have differing maximum loan amounts due to these unique statutory limitations. The conforming loan ceiling for single-family homes in these locations is $822,375.

In 2023, the maximum conforming loan limit will be greater in all but 43 counties or county-equivalents in the United States as a result of generally growing property prices, the increase in the baseline loan limit, and the rise in the ceiling loan limit. Here is a breakdown of what states allow for maximum loan amounts.